If you aren’t careful, attackers can use bank scams to drain your savings and leave you in a bind. Being able to spot scam techniques makes you a much more difficult target. Help protect your finances by learning how to identify attacks and using a bank account and credit monitoring tool like LifeLock Ultimate Plus.

The goal of a bank scam is typically to steal money or financial information. If an online attacker is successful, it can be difficult (and sometimes impossible) to recover lost funds. In the end, the time it takes to recover from this type of financial fraud mostly depends on how long it takes you to notice there’s a problem, whether the authorities catch the attacker, and if your bank can reverse the transactions.

In this guide, we'll tell you how to detect scams, share tips for protecting your earnings from financial fraudsters, and explain what your options are if you fall prey to a banking scam.

Beyond that, bank scams tend to work a bit differently depending on the category they fall under.

Hackers are getting creative with their scams as online banking becomes more commonplace. Here are five examples of current bank scams you should look out for:

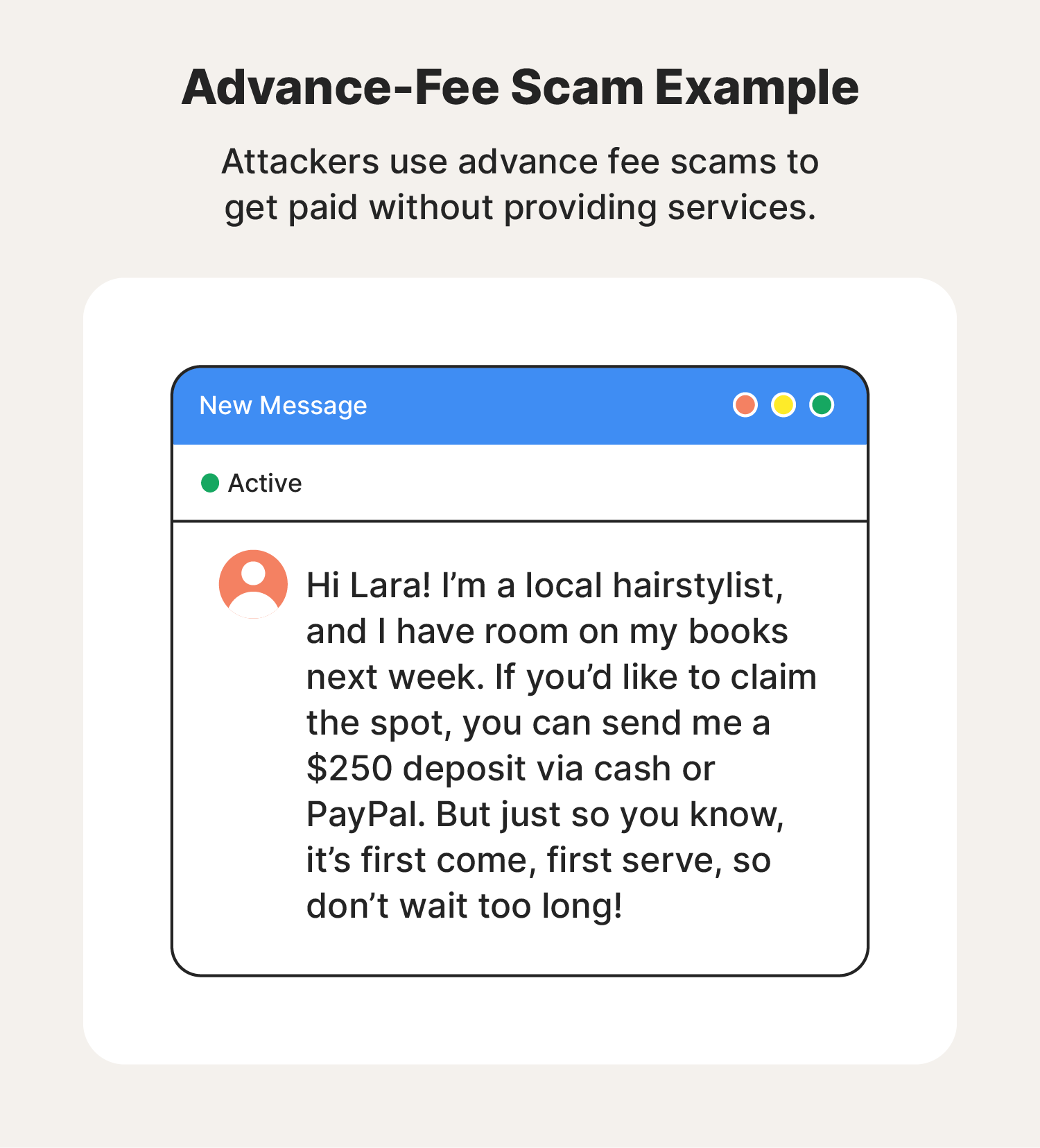

An advance-fee scam involves an attacker tricking their target into paying a deposit or other upfront charges before they agree to ship a product or schedule a service. This type of scam doesn’t involve bank infiltration, but it often involves using payment services like CashApp and Zelle to exploit consumers and harm their financial well-being.

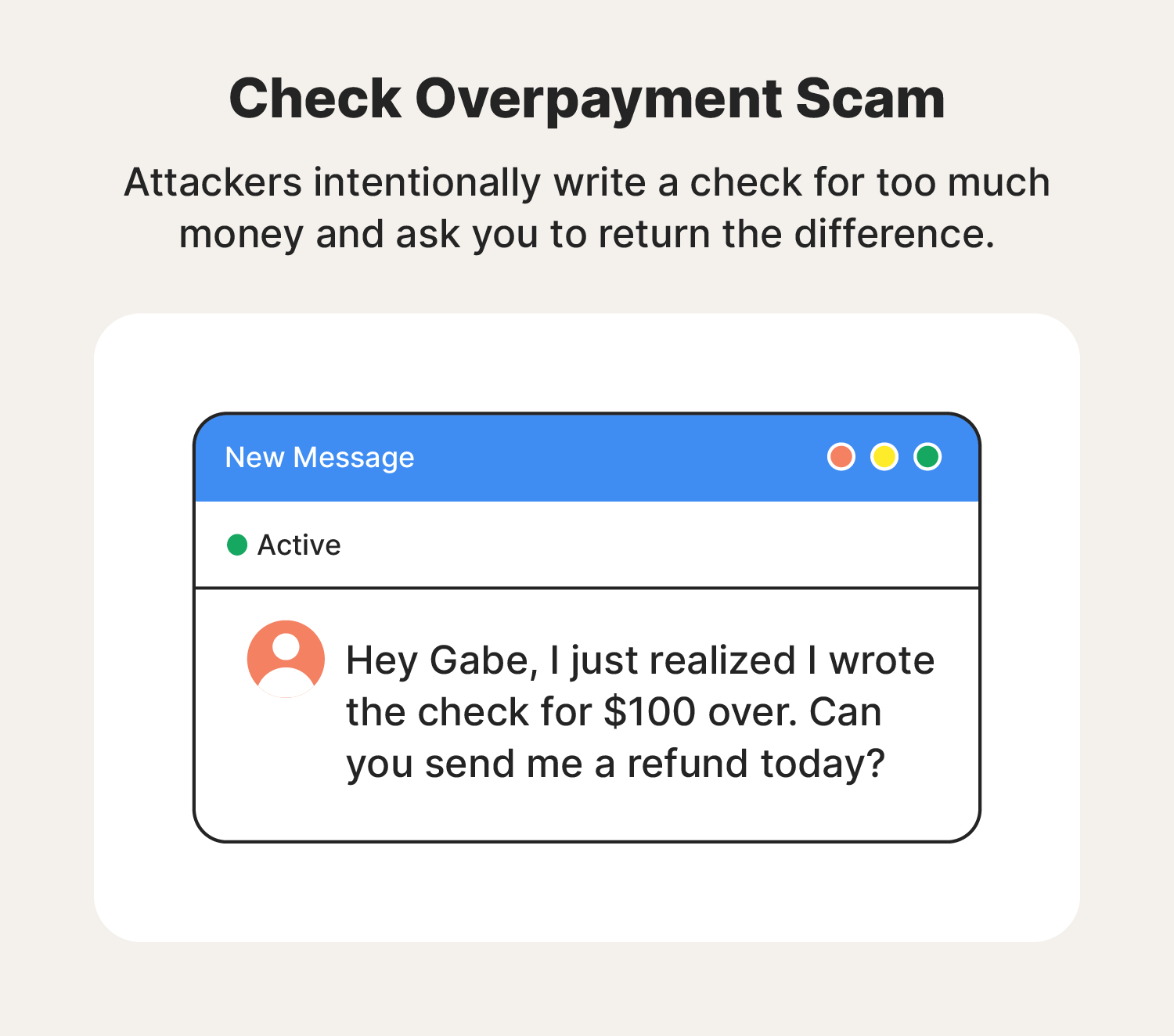

An overpayment scam involves a scammer intentionally writing a check for too much money and asking the recipient to refund the difference. Typically, these checks are designed to bounce, and they’ll try to collect the money and disappear before the bank flags the deposit.

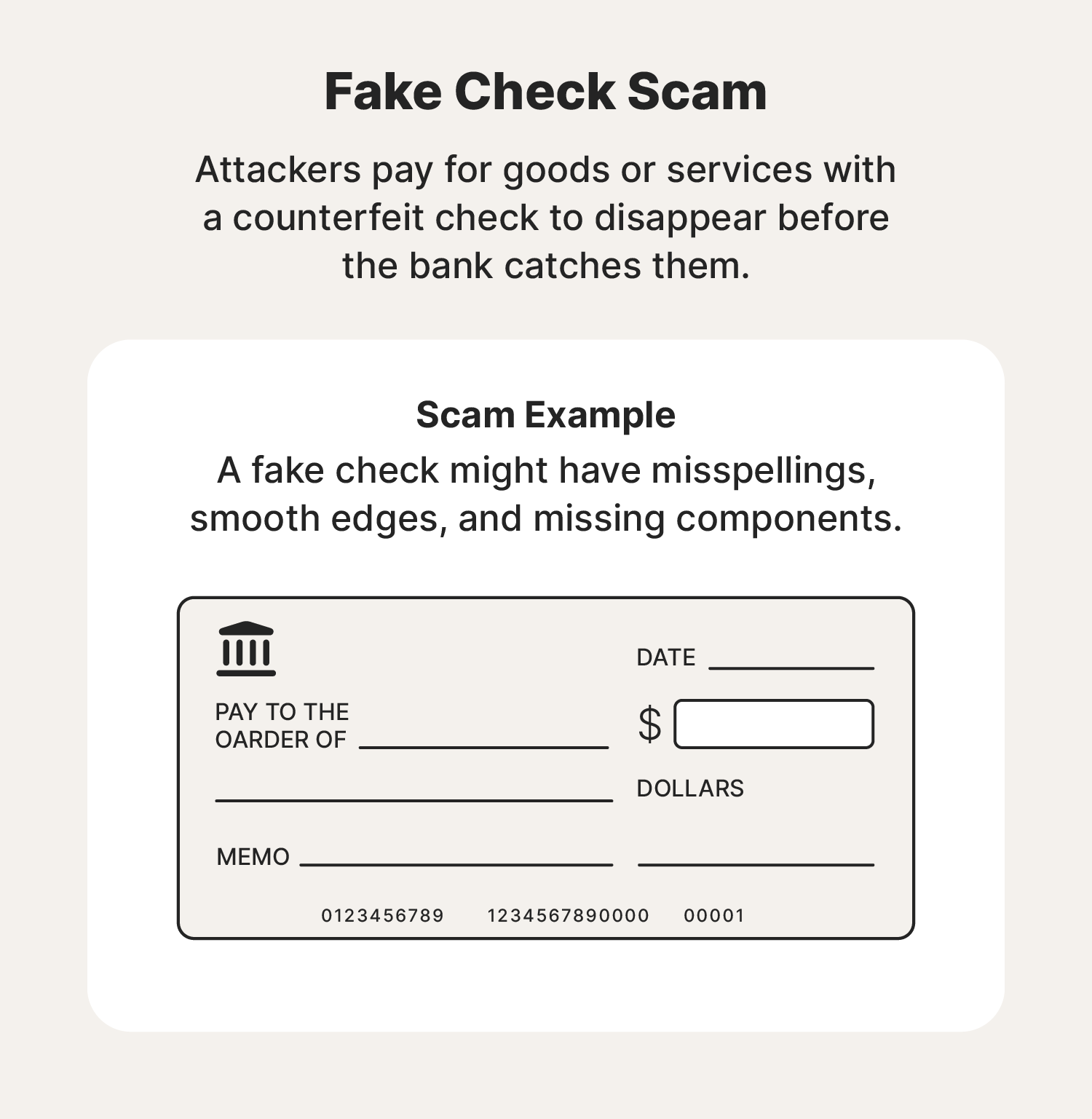

Fake check scams involve attackers paying for goods or services with a phony check. This allows them to get away with stealing because it can take a few days for the bank to process the check and flag it as a counterfeit.

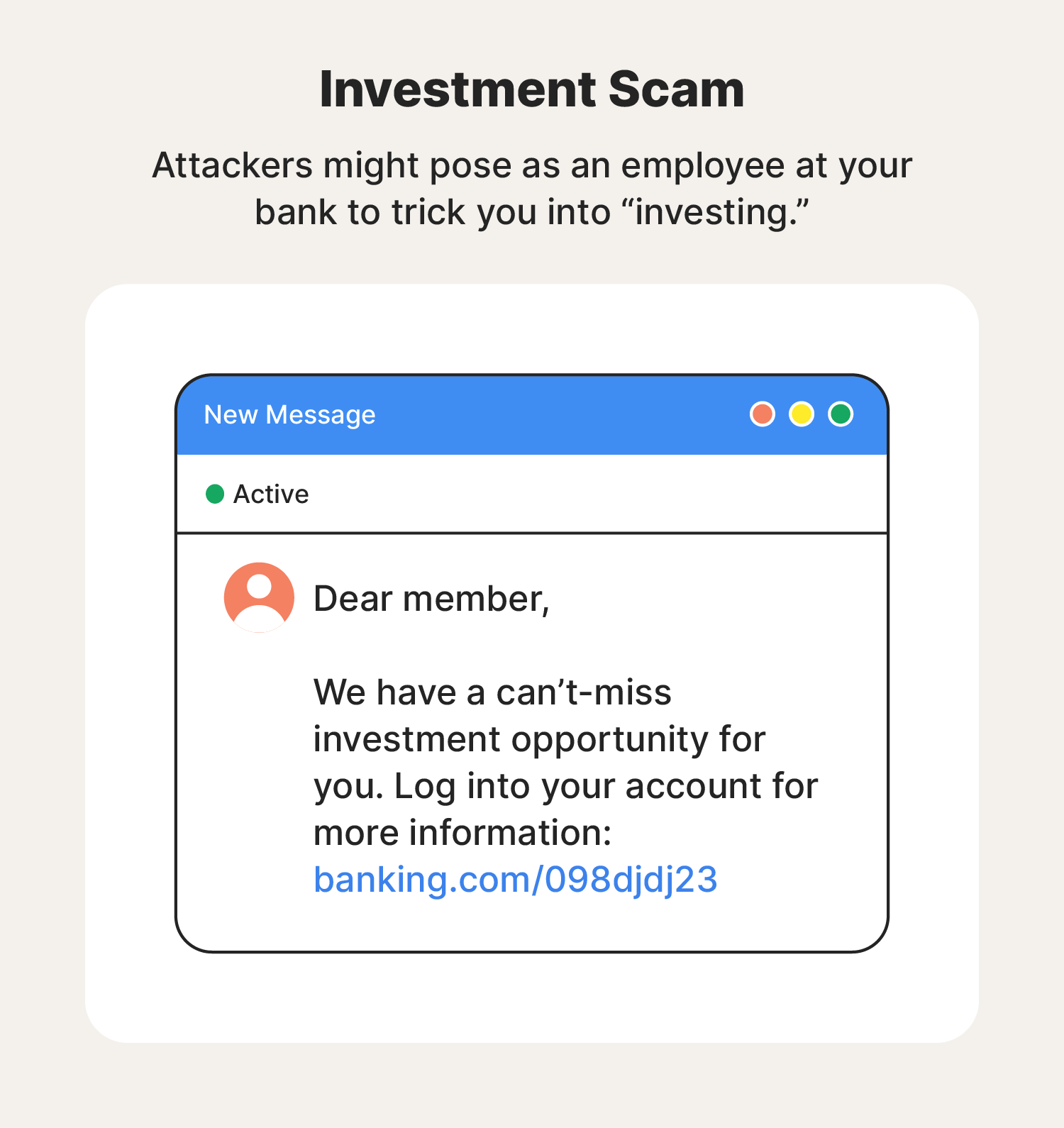

Investment scams involve an attacker posing as a bank representative and offering bogus opportunities to invest in mutual funds, stocks, bonds, high-yield savings accounts, or certificates of deposit (CDs). Once a bank member sends the money or enters their login information on a spoofed website, the cybercriminal can re-route the funds to themselves.

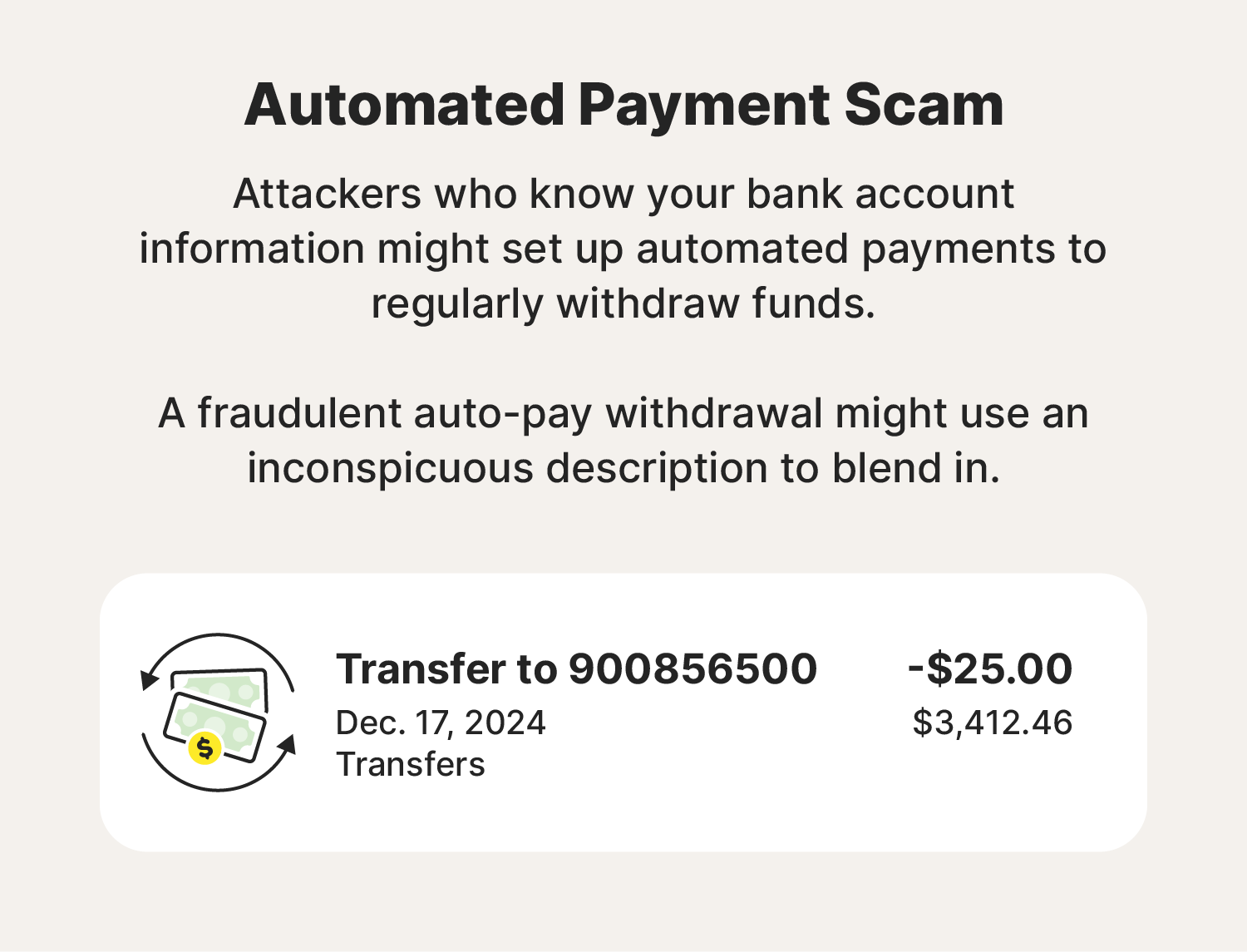

Automated payment scams typically happen when a fraudster already has their target’s account information. Using the account and routing numbers, they set up automatic payments to siphon funds out of the account over time. If they choose a small enough amount and the account holder doesn’t closely review their bank statements, the scammer can withdraw quite a bit of money before they notice.

Cybercriminals typically use social engineering tricks, like pretending to be a bank teller or investment broker, to commit bank account fraud. However, you might notice different warning signs if they accessed your account using login combos they found on the dark web, through a brute-force attack, or a data breach.

Regardless of how they steal your information, here are some red flags to watch out for:

You trust your bank, and hackers know that. That’s why they’ll use the financial institution’s earned trust to exploit you and disappear with your savings. Fortunately, with a proactive approach to banking security, you can keep fraudsters away from your account.

Here are the top five ways to safeguard your accounts:

Secure your accounts with strong and secure passwords. This makes it harder for hackers to guess your login credentials with tactics like brute force attacks. As a second line of defense, consider setting up two-factor authentication (2FA)—this prevents hackers from getting into your bank account even if they have the right login combination.

Most of us need to connect to guest Wi-Fi at some point, regardless of the risks. However, you should avoid discussing personal information or purchasing until you disconnect from the unsecured network. Otherwise, hackers might successfully intercept your banking details with man-in-the-middle or packet sniffing attacks. And if you do use a public network, be sure to use a mobile VPN to keep your connection safe from prying eyes.

Sometimes, scammers pose as someone from your bank and send you bogus loan or investment offers. If this happens to you, talk to the advisors at your bank to determine if the offer you received is legitimate and learn more about the opportunity. Be on the lookout for fake texts and email scams, especially when they come from unverified channels, and ask you to click a link to learn more.

Only download mobile banking apps through the financial institution’s website or a reputable app store to avoid spoofing and malicious communications. Even if your bank does send you texts and emails, you should still switch to the app or some other secure channel to reply. This can help keep discussions about your finances private and avoid clicking on bad links.

Identity theft protection is a savvy way to protect your finances because it can help you catch suspicious activity before the damage is done. Advanced services like LifeLock Ultimate Plus even assist with bank account withdrawal, balance transfer, and takeover alerts, giving you a bird’s eye view of your finances and potential threats.

As if bank scams aren’t stressful enough, you’ll also need to take swift action to ensure your money isn’t permanently lost. Here’s what you need to do to recover your account and any money stolen from it:

No matter how careful you are, some threats may still slip through. That’s why you should safeguard your online banking accounts with powerful data and identity theft protection.

LifeLock Ultimate Plus offers ironclad protection by monitoring your accounts and flagging high-risk transactions. And in the event your funds or identity are stolen, you’ll get expert technical and legal help during the recovery process. Get trusted identity protection today.